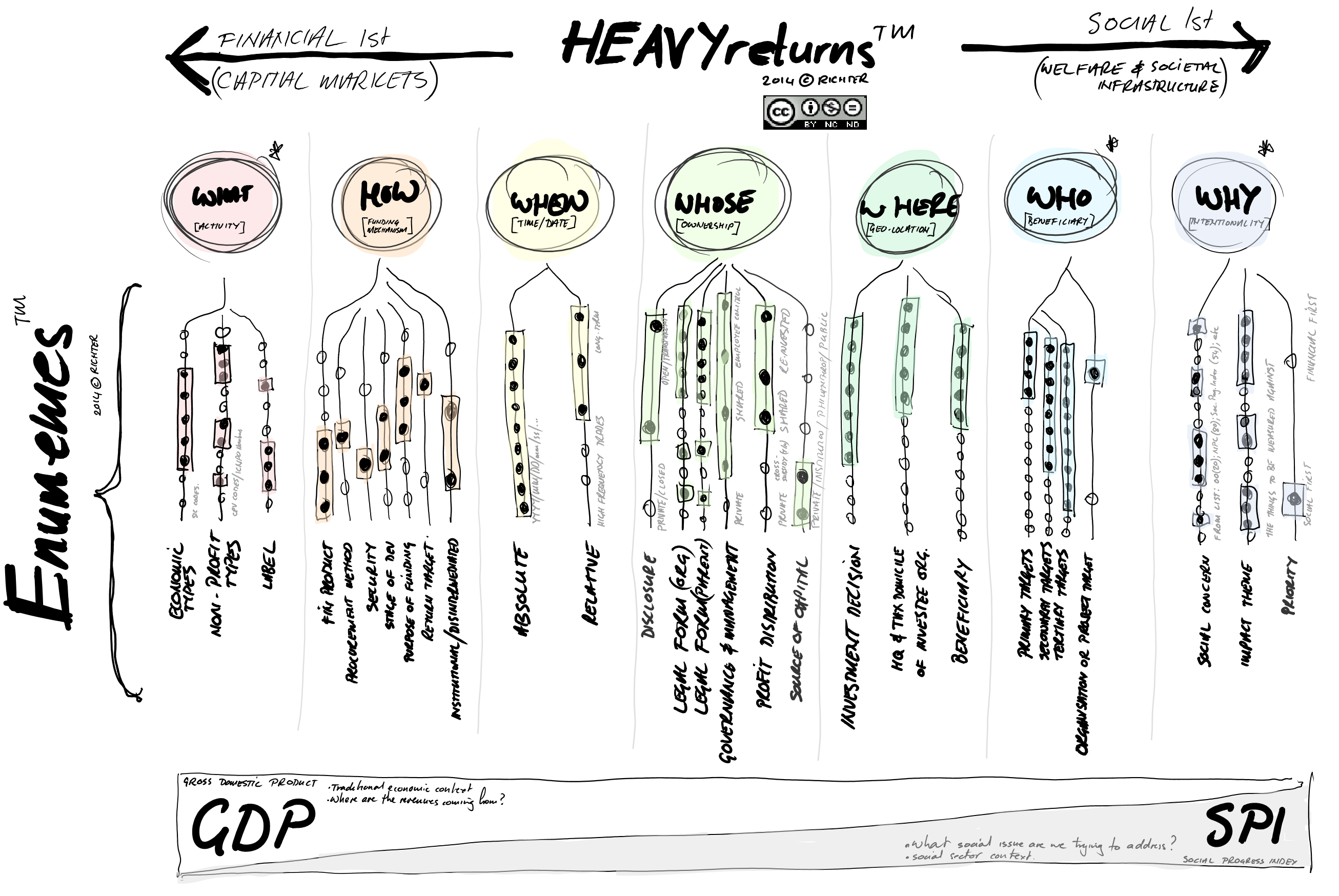

The Aggregate Confusion Project at MIT has done a great job of analysing why there is a tremendous divergence between different sources of impact data (sustainability data). They conclude that the biggest contributing factor is that different people fundamentally measure impact in different ways. Furthermore, people organise the various attributes according to different scopes, and assign different weights to each attribute. These three categories of measurement, scope, and weights provide a good starting point for fixing the problem.Read More »